Access Bank

Branding

Combining

two banking power-houses

The merger of two banking powerhouses created the largest retail bank in Africa. Access Bank being a leading bank for business – trusted, global and fast whilst Diamond Bank was a leader in digital banking – youthful, vibrant and with a human approach. The challenge of the rebrand was to build one unified banking superpower that put customers at the heart.

Banking on the future of Nigeria

The merger involved an 18 month process, complete with in-depth research of the two banks customer needs. This included focus groups and meetings with leaders to understand what they did best to align one unified offer. A new promise of ‘more than banking’ was established – more branches, more products, more accessibility, more customer service – positioning the bank as one, helping customers reach their financial potential.

A new logo and visual system was created using elements from both brands to create one unified brand. Redesigned branches was a priority to enable face to face customer service, supported with easy to understand marketing material, a new website and further investment in digital banking for the region – all helping reassure a new generation of customers that this is a bank for the future.

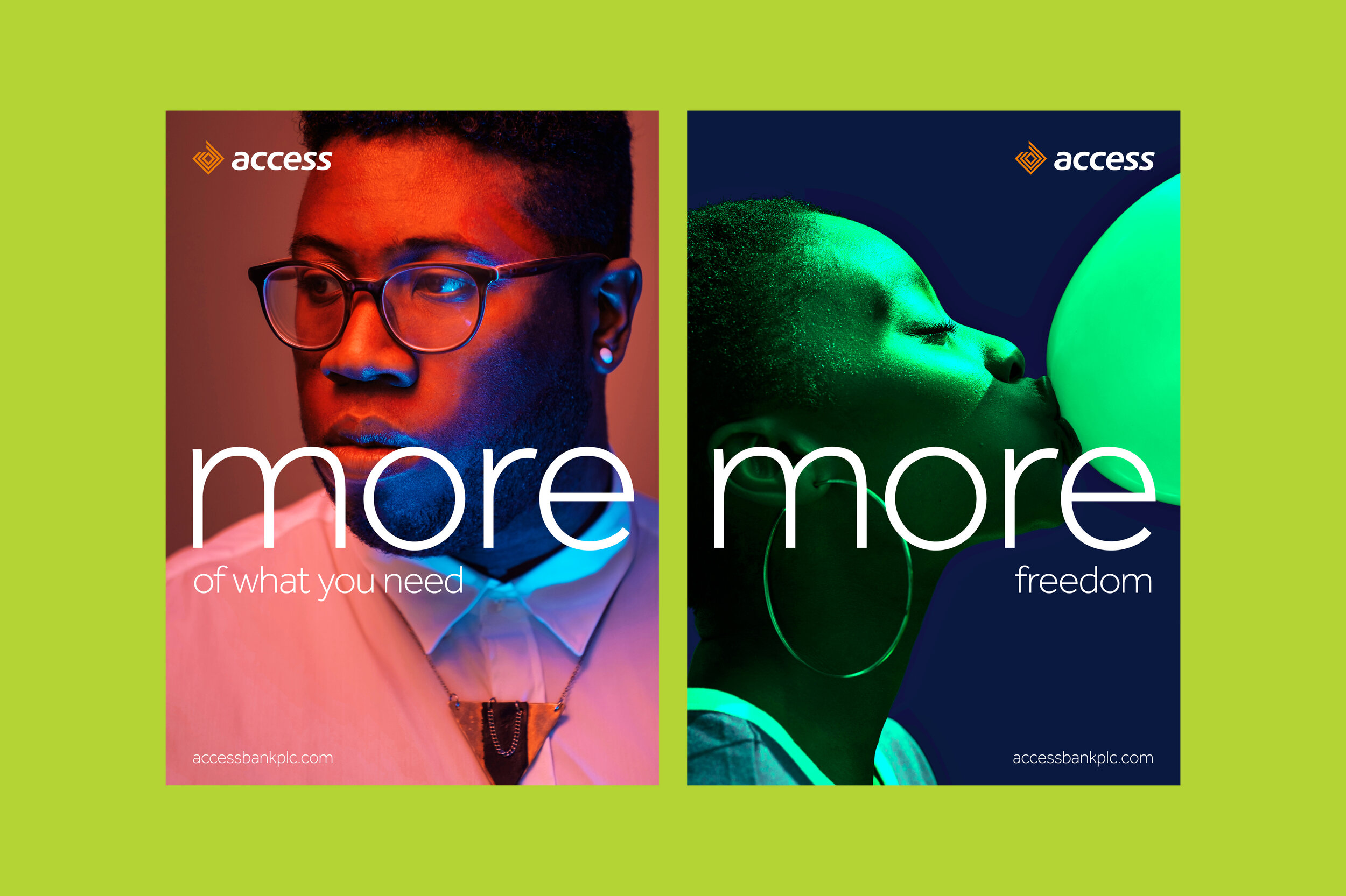

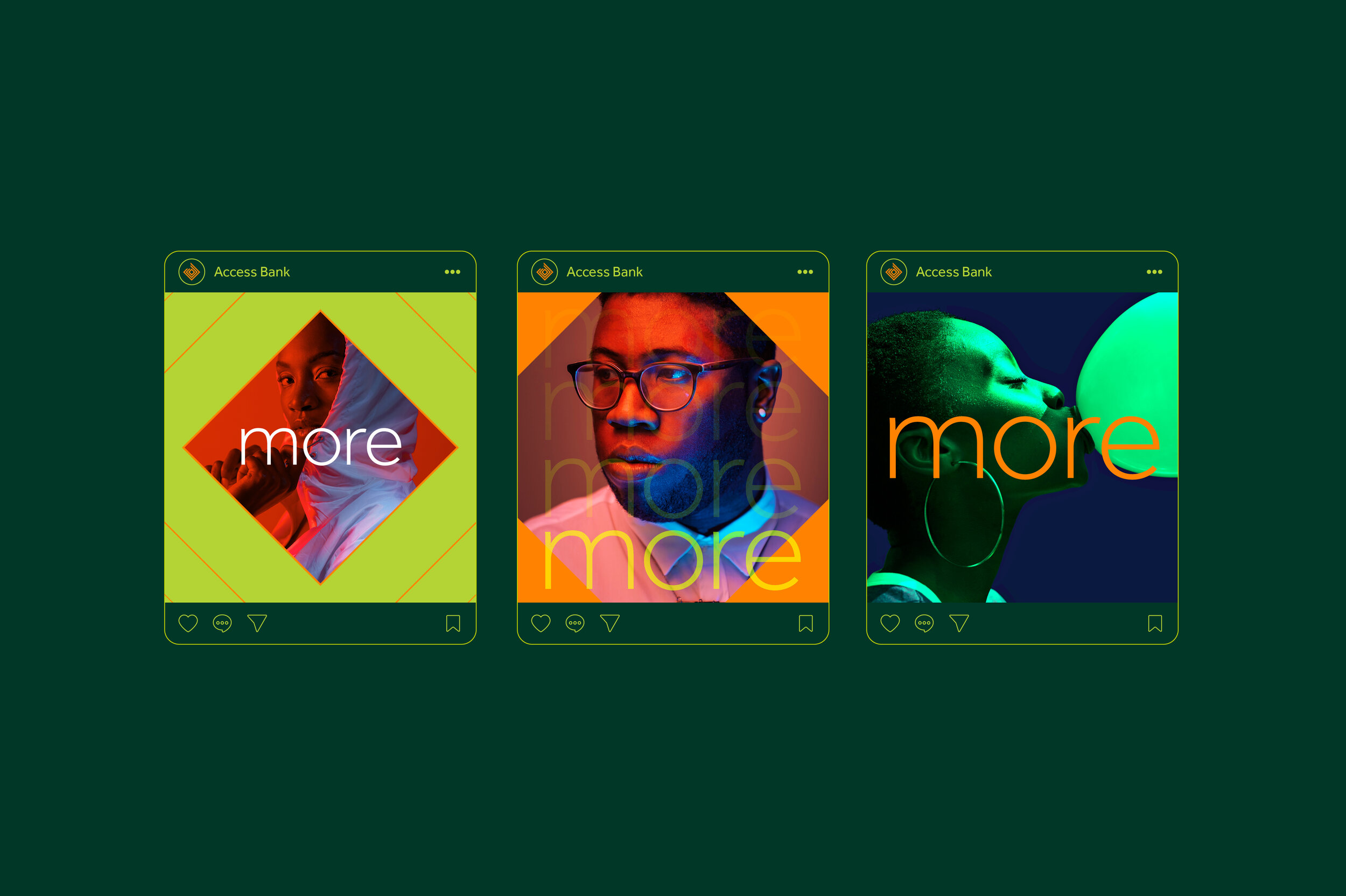

A launch with the promise of ‘more’

To launch we focussed on the promise of ‘more’ to highlight that everyone is unique and Access Bank is there to support their life journey. The campaign promotes that customers are no longer a data point, by offering personalised services and experiences to help achieve financial success.

In a crowded marketplace, the campaign helped differentiate Access Bank from their competitors by taking the time to understand the special details of each customer and tailor solutions to meet their needs.